Artificial intelligence has made its mark in almost every industry, and the banking sector is no exception. It is making a big difference by improving how financial institutions operate and how they serve their customers. It’s being used in many ways, from helping with customer service to spotting fraud and managing investments.

Financial institutions have already actively started using AI in banking to make their services smarter and more efficient, which is clearly visible from the growing market statistics. According to Grand View Research report, the worldwide AI in banking market is expected to reach $143.56 billion by 2030. Banks are also using AI to analyze data and boost sales, with some seeing a 30% increase in turning leads into customers.

With all these positive changes, it’s clear that integrating AI is now a must-have for banks that want to stay competitive. Without a doubt, it is making digital banking even more important, and financial institutions that invest in it will have a big advantage in the future.

Want to know more about what wonders artificial intelligence in banking can do? Then keep reading this blog.

What is AI in Banking?

Integrating AI in banking has created quite a buzz around the world, but have you ever wondered what it actually is? AI in banking industry involves using powerful technologies like machine learning and natural language processing to automate complex tasks, personalize services, and enhance security.

Instead of relying on outdated systems that required a lot of manual work, AI uses smart algorithms, models, and high-quality data to make processes smoother and more efficient. While AI banking software can greatly improve services for both banks and customers, it’s important to use it responsibly to ensure it benefits everyone.

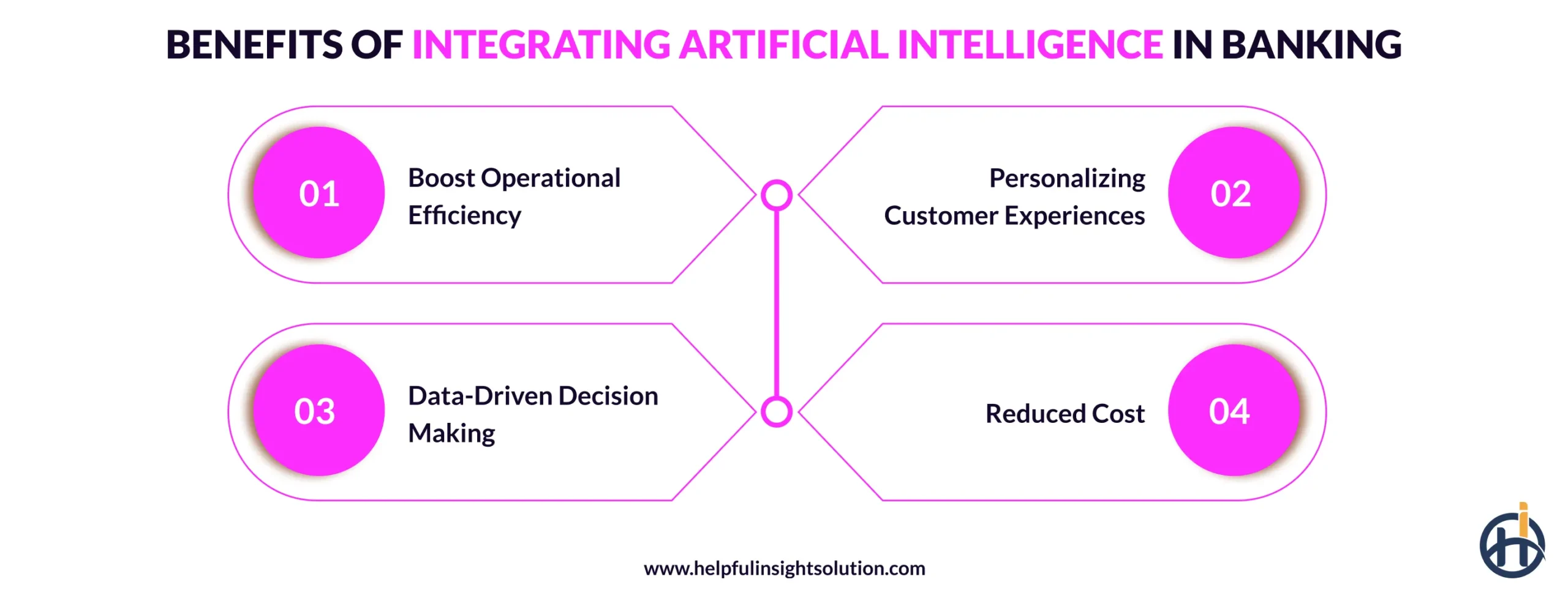

Benefits of Integrating Artificial Intelligence in Banking

The introduction of AI in the banking and finance sector has proven to be a game changing move for the industry. It has brought a 360-degree change to how banks deliver services and how customers receive them.

In this section, we will discuss the key benefits of AI in banking software.

1. Boost Operational Efficiency

One of AI’s core strengths is automation, which helps banks streamline repetitive and time-consuming tasks, ultimately improving operational efficiency. AI can handle jobs like checking documents, answering common customer questions, and managing routine data entry. This allows employees to focus on more strategic and valuable work.

2. Personalizing Customer Experiences

In today’s competitive world, offering personalized services is key to success, and AI makes this possible. By analyzing customer data, AI understands their needs and preferences. Additionally, AI-powered chatbots provide quick, personalized support, making customers feel valued. This results in happy, loyal customers who trust the bank and stick around for the long term.

3. Data-Driven Decision Making

Data is one of the most valuable assets of a business, and artificial intelligence can help you make full use of it in the right way. AI can quickly process large amounts of data to help banks make better decisions. Instead of waiting for manual checks, it can instantly assess risks, approve loans, and detect fraud. This speeds up processes and increases accuracy.

4. Reduced Cost

Running a bank involves a range of costs, but integrating AI into banking provides a golden opportunity to save money. AI helps banks save by automating repetitive tasks. Chatbots handle customer questions, reducing the need for large call centers. By cutting manual work, banks can save on labor costs and make their services more affordable for customers.

Read Also: Key Considerations For Estimating Banking App Development Cost

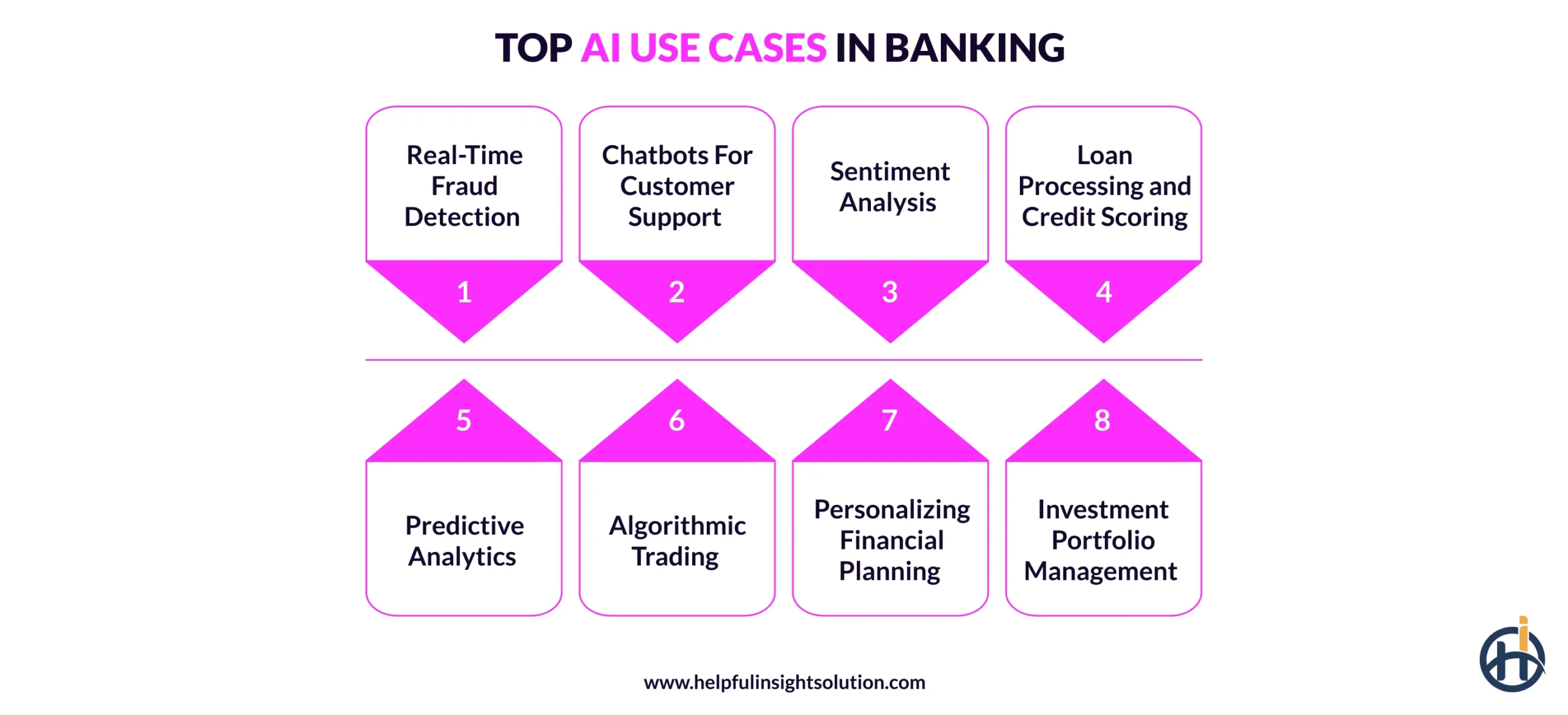

Top AI Use Cases in Banking

If you think AI in banking is limited to just automation, then no, it has evolved far beyond that. Investing in custom AI banking software development brings benefits across various areas of your banking operations.

Let’s explore the best AI in banking use cases:

1. Real-Time Fraud Detection

Security is fundamental to the operations of banks. Artificial intelligence help financial institutions spot fraud in real-time by analyzing data quickly. It can detect unusual patterns, like fake transactions or stolen identities, and stop them before they cause harm. This saves banks and customers money by stopping fraud early.

2. Chatbots For Customer Support

Banks can use AI chatbots and virtual assistant to deliver fast and personalized customer services. These chatbots can help customers check account balances, track spending, and solve basic problems anytime, day or night. They help reduce wait times and let human agents focus on harder tasks.

3. Sentiment Analysis

This is one of the innovative AI in banking use cases where the AI system understands how customers feel by looking at what they say online or during calls. It helps banks know when people are unhappy or excited. This lets them fix problems quickly and offer better, more personalized services based on how customers feel.

4. Loan Processing and Credit Scoring

Loan approval is a very time-consuming process, especially for customers, and banks also have to do a lot of paperwork. AI in banking accelerates the process of loan approvals by analyzing vast datasets quickly and accurately. It checks credit scores, automates document verification, and other details to decide if a loan should be approved or not.

5. Predictive Analytics

The financial market keeps going up and down, so to help banks prepare with their strategies and better handle market supply and demand, AI helps banks predict future trends, such as currency shifts or potential market crashes. It uses past transaction patterns to forecast credit risk, identify customers at risk of leaving, and plan cash needs for ATMs.

6. Algorithmic Trading

AI improves trading by quickly studying complex data and spotting patterns faster than humans. It can make trades automatically, based on market changes. By constantly monitoring market conditions, artificial intelligence helps predict losses and adjusts investment strategies. It adapts to changes without needing constant manual updates. Isn’t it great?

7. Personalizing Financial Planning

Every person does financial planning on how and where they are going to spend. An AI tool can be a helping hand in this, making the process easier. It studies a person’s financial habits, looks at factors like spending patterns and goals, and offers right advice which can help them in making informed financial decisions.

8. Investment Portfolio Management

Generative AI in finance and banking is changing how investment portfolios are managed by analyzing voluminous data to predict market trends. It looks at everything from financial reports to social media sentiment, helping make smarter investment choices. It also tracks risks and adjusts portfolios in real-time.

Key Challenges of Adopting AI in banking industry

There’s no doubt that AI in banking has brought positive transformation to the industry, but integrating it isn’t easy. It comes with its own set of challenges that must be addressed before investing in AI development services. These challenges include:

| Challenge | Description | Solution |

| Data Security Concerns | AI in banking uses lots of personal data, which can lead to security risks like data breaches. | Banks need to use strong security methods like encryption and secure data storage to protect customer details. |

| Legacy Systems Integration | Traditional banking systems weren’t made AI ready, so adding AI to them can be expensive and complicated. | Upgrade old systems gradually and use solutions that work with both new AI and old technology. |

| High Cost | Integrating AI requires expensive technologies and hardware, which can pose challenges for smaller banks. | It would be best to invest in the right AI banking solutions with clear benefits. |

| Resistance to Change | Some bank employees fear AI will replace their jobs, making them resistant to adopting new technology. | Provide training and explain how AI will make jobs easier, not replace them. |

Future of AI in banking: What’s Next?

Every industry is slowly moving toward digital transformation, and the banking sector doesn’t want to fall behind. Customers now expect fast, automated services while still wanting a personal experience. To meet these demands and stay ahead of the competition, banks are investing in AI.

AI is transforming the banking industry for the better, and it’s exciting to think about what the future holds. One thing is clear, financial institutions need to keep improving their systems to fully benefit from AI as this technology grows rapidly.

The future trends of AI in banking we can expect to see are:

In the coming years, we can expect the rise of agentic AI in banking, making the system smarter. How? AI will start making decisions and handling tasks on its own, without waiting for commands.

As banks grow and handle more data, managing it becomes harder. This is where adoption of cloud-based architecture will be beneficial. It will help manage large amounts of data and improve AI performance.

In banking operations, security is non-negotiable. In the future, development of advanced AI-threat prevention systems will be essential. AI will detect cyber threats and respond faster, even preventing attacks before they occur.

So definitely, the future of AI in banking seems to be bright.

Why Choose Helpful Insight to Develop an AI-Powered Banking App

The banking sector is shifting from a digital-first to an AI-powered approach. This shift means banks are becoming faster and more efficient at everything they do.

Many banks have already adopted AI in their operations, while others are eager to follow suit. AI is reshaping how banking works and enables banks to compete more effectively in this AI-driven era.

Our AI app development company specializes in designing, developing, and implementing AI solutions for the banking sector. With a deep understanding of the banking and finance industry,

we know their needs and challenges, allowing us to develop secure and customized AI banking systems. Whatever your AI needs are, our AI developers can create the perfect solution to address various AI use cases in banking, all at cost-effective rates.

At Helpful Insight, we’ve helped clients maximize business value with AI systems, and we’d be happy to help you too. So, what are you waiting for? Reach out to our AI experts and let us help you build an AI banking system that will transform your banking operations.

FAQs

To build a high-quality AI banking system, you need to follow a series of steps. It’s a complex process, so it’s best to hire AI developers. The steps involved are

- First, define the purpose of why you need an AI solution and what problem it will solve.

- Choose the suitable tech stack for AI software development.

- Collect quality data and prepare it to train AI models.

- Start developing the AI model and train it using quality data.

- Test the AI model and integrate it into your banking system.

The cost to build an AI banking app is influenced by a wide range of factors, such as project scope, feature complexity, AI model development, customization level, UI/UX design, and the location of AI app developers.

Therefore, it is difficult to state the exact app development cost. On average, the AI banking app development cost can start around $30,000 to $ 300,000 or more.

Get in touch with our team to receive a personalized quote.

To ensure the smooth integration of AI in banking, it is important to follow some of the best practices, which include:

- Start with clear business goals.

- Ensure clean, accurate, and reliable data.

- Run pilot projects before full deployment.

- Track results and make improvements.

Some of the prominent AI in banking examples are:

- Bank of America’s AI assistant, Erica, helps customers by reminding them of upcoming bills and tracking spending patterns.

- Mastercard uses AI model to quickly detects stolen cards by analyzing billions of transactions, helping prevent fraud..

- HSBC uses AI to spot suspicious activities and improve anti-money laundering efforts.