“Power your finance and banking services with affordable mobile solutions.”

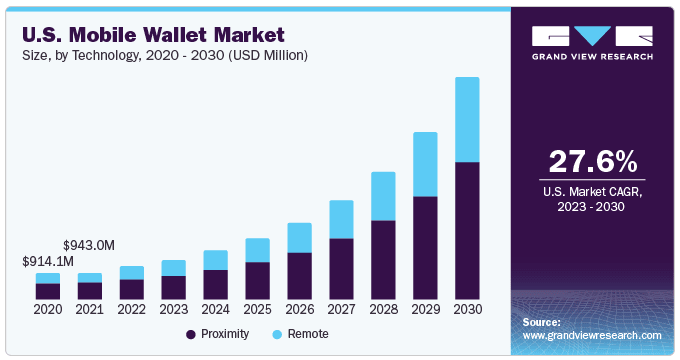

Do you run a bank in the USA, observing varied user issues like regular visits, unsatisfactory results, and query settlement? It is the right time for you to go online and start delivering your banking services to mobile or web users. Before that, you need to know the banking app development cost to manage resources and regulate data security. The current mobile wallet sector is expected to make a total revenue of $51.5 billion at the end of 2030, growing at a rate of 8.5% CAGR.

This has created several opportunities for entrepreneurs at the global level and helped them in making market-ready applications. Connecting with the best mobile banking application development companies in the USA or other regions is both beneficial and profitable at the same time. They assist you in providing security and privacy of digital assets with limited changes.

It is fascinating to know that development rates are dependent on various factors that you can manage easily with reading methods. You only need the support of a professional fintech mobile app development company. Let’s move further in this blog and get more details.

Stats On The Expanding Global Banking Sector

The banking industry is creating a lot of opportunities for mobile app development and will generate more in the coming years. Businesses must target fintech app development solutions to deliver unique and highly secure mobile banking services to users:

- In 2025, the overall revenue of traditional banks globally is $8.8 trillion, which is expanding at a rate of 5.3% CAGR between 2025 and 2030.

- The projected income is $11.4 trillion by the end of the tenure in 2030, with a total profit of $7.2 trillion.

- For the USA, the expected income is $667.5 billion in 2025, which will reach $896.8 billion in 2030 at a rate of 6.1% CAGR.

- The global revenue for digital banks in 2025 is $1.6 trillion, which is growing at a rate of 7.1% CAGR. It will reach $2.2 trillion at the end of 2030.

- In this segment, China is generating the maximum revenue of $497.8 billion in 2025 and will beat the UK by the next year.

These stats will encourage you to invest in making smartly integrated digital payment applications. It is beneficial to hire a fintech application development company for a better understanding of the fintech market and growth possibilities.

Why Should Businesses Invest In Digital Banking App Development?

There are multiple benefits that businesses can get by investing money in fintech app development. Other than monetization, they include growth and expansion in various industries. In this section, we will find out those advantages:

1. Fast Transactions

Through NFC mobile payments, users can instantly transfer money to their contacts and other merchants. This is beneficial for investors, as it is highly secure and requires user authentication before transactions.

2. Revenue Opportunities

Businesses can generate consistent income through various revenue models, such as advertising. It helps to create a balance between the banking app development cost and money earned from premium features.

3. Consistent Growth

With regular mobile payments, entrepreneurs get more advantages to grow in a particular sector. You can approach a mobile banking app development company to make sophisticated business models.

4. Business Expansion

It is easy to expand banking services in various domains like insurance, trading, and loan management. Businesses can hire fintech app developers who can make integrations for seamless expansion.

Average Breakdown Of The Banking App Development Cost

As a business investor, what is your first step in the process of developing a financial app? You might be thinking of the banking app development cost and factors that are responsible for the price rise. At the initial level, it is important to choose the right place to create advanced money transfer platforms. The average Flutter application development cost ranges from $6,000 to $30,000 based on different regions. Additionally, more factors influence the overall price, impacting NFC mobile payments, customer support, and e-wallet features.

| Location Factor | Average Cost (USD) | Best Services Offered |

| India | $8,000-$10,000 | Custom Mobile Banking App Development |

| UAE | $10,000-$12,000 | Islamic Banking App Solutions |

| Brazil | $12,000-$14,000 | Fintech Integration Services |

| South Africa | $14,000-$16,000 | Digital Wallet Development |

| Russia | $16,000-$18,000 | Core Banking System Modernization |

| France | $18,000-$20,000 | Neo-Banking App Development |

| UK | $20,000-$22,000 | Open Banking API Development |

| Australia | $22,000-$24,000 | Mobile-First Banking Solutions |

| Canada | $24,000-$26,000 | AI-Powered Banking Chatbots |

| USA | $26,000-$30,000 | Enterprise-Grade Banking App Development |

You may approach a reliable mobile banking app development company for better clarity about the cost of making fintech apps. They help entrepreneurs to prepare budget plans based on different business requirements, hire skilled mobile banking app developers, and balance expenses. It is crucial to see other cost-affecting factors for accurate pricing and estimation.

Major Factors Affecting The Cost To Develop Mobile Banking Apps

The development process, complexity, and developers’ experience are some major factors that influence the banking app development cost. It’s time to discuss each cost-affecting factor with detailed information. Here, we will also see their cost tables:

1. Project Complexity

The financial app development cost is highly dependent on the complexity level and the number of features included. You can find the estimated price with our cost calculator, which involves different parameters. This helps you in choosing the right features at affordable rates.

| Project Complexity | Average Cost (USD) | Timestamp |

| Simple | $6,000-$10,000 | 2 to 3 months |

| Intermediate | $10,000-$50,000 | 4 to 8 months |

| Complex | $50,000-$150,000 | 8 to 12 months |

| Advanced | $150,000-$250,000 | 12 to 24 months |

2. Development Platform

It is important to choose the right platform for developing banking apps based on the business requirements. For building apps on both Android and iOS, you can use affordable hybrid platforms. A finance app development company helps you select the best platform at the right prices.

| Development Platform | Average Cost (USD) |

| Hybrid | $10,000-$80,000 |

| Android | $15,000-$120,000 |

| iOS | $18,000-$150,000 |

3. Hiring Model

You can hire mobile banking app developers through different hiring patterns. For cost-effective development, you can build in-house teams or choose freelancers, but they do not ensure credibility. So, it is beneficial to outsource developers with good experience who may have higher rates.

| Hiring Model | Average Cost (USD) |

| Freelancers | $2,000-$5,000 |

| In-House | $5,000-$8,000 |

| Developer Outreach | $3,000-$5,000 |

4. Team’s Experience

Businesses can hire senior or professional banking app developers who are available at expensive prices. They are suitable for big enterprises looking to make banking applications from scratch. Small entrepreneurs can hire junior or mid-level developers to create simple payment platforms.

| Team’s Experience | Average Cost (USD) | Experience (in Years) |

| Junior Level | $2,000-$5,000 | 1 to 2 Years |

| Mid Level | $5,000-$8,000 | 2 to 5 Years |

| Senior Level | $8,000-$10,000 | 5 to 10 Years |

| Professional | $10,000-$15,000 | More than 10 Years |

5. Tech Stack

A tech stack must include various backend or frontend tools and technologies, like AI, that are advanced. To get the latest fintech app development solutions, you should implement a suitable tech stack. Additionally, it is important to choose the necessary tools available at affordable rates.

| Advanced Technologies | Tools & Technologies | Average Cost (USD) |

| Cloud Computing | $3,000-$6,000 | |

| Blockchain | $6,000-$12,000 | |

| Artificial Intelligence | $12,000-$16,000 | |

| Cybersecurity | $16,000-$22,000 | |

| Development Tools | Frontend | $5,000-$10,000 |

| Backend | $15,000-$25,000 | |

| Database | $10,000-$15,000 | |

| API | $15,000-$20,000 |

6. Design Restrictions

Digital banking apps increase their revenue through effective UI/UX design solutions. Additionally, their development must be affordable with one-click events and page navigation features. So, you must use fintech mobile app development services to ensure a seamless and cost-effective approach.

| Design Restrictions | Average Cost (USD) |

| Theme Automation (CSS) | $1,000-$2,000 |

| On-Click events (JavaScript) | $2,000-$4,000 |

| Page Navigation (React JS) | $5,000-$10,000 |

7. Security Charges

Security is a major cost-affecting factor that involves different encryption methods like OAuth 2.0 or authentication. You can approach a banking app development company to know about the security implementation cost. So, it becomes easy to integrate a suitable infrastructure for data safety.

| Security Charges | Average Cost (USD) |

| Login Features | $1,500-$2,000 |

| Database Integration | $2,000-$3,000 |

| OAuth 2.0 or 2FA | $3,000-$5,000 |

| XML Scripting | $5,000-$8,000 |

9. App Maintenance

The mobile app maintenance is included in the fintech app development services. It involves multiple parameters like security checks, bug testing, and feature enhancements that determine the cost. To enhance platform efficiency, you must implement maintenance services at affordable prices.

| App Maintenance | Average Cost (USD) |

| Bug Fixing | $500-$1,000 |

| Feature Updates | $1,000-$2,500 |

| Performance Analysis | $2,500-$4,000 |

| Security Checks | $4,000-$5,000 |

How To Reduce The Cost Of Building Fintech Applications?

It is important to know which methods help entrepreneurs reduce the banking app development cost. So, they can timely identify business flaws, mitigation risks, and possible inflation challenges. Let’s discuss the cost-reducing methods in this section:

1. Build MVP Models

The first method is building prototypes and wireframing the exact platform through different business models. With this, you can easily use banking application development services at affordable rates. Additionally, the identification of the tech stack and features becomes easy for businesses.

Read Also: How To Develop an MVP: A Step-By-Step Guide

2. Third-Party Solutions

For cost-effective NFC payment app development, you need to implement white-label solutions. This includes integrated APIs, AI development services, Cloud platforms, and databases. They offer business-oriented features and help to engage a large number of users.

3. Manage Resources

It is important to prioritize various development resources like app features, technologies, and mobile frameworks. You can approach leading fintech app development companies to make an efficient blueprint model. So, the management process becomes easy and fast, reducing the overall cost.

4. Agile Development Approach

You must ensure a quick and smooth development process by using agile methods and providing instant support. It is beneficial to hire a banking app development company that has experience with similar services. With this, you can decrease the total cost of building financial apps.

5. Target Cost-Effective Regions

Businesses can hire React Native developers from cost-effective regions like India or the UAE. These countries offer affordable development models, fintech app developers, and resources. The technology is advanced and provides a highly effective environment for developing mobile apps.

6. Mark Potential Errors

Various risks or technical errors may occur during the banking and finance app development process. In this case, you should connect with a fintech app development firm to get accurate details and a problem outline. So, the overall development cost can be reduced, and revenue can be increased.

Top 10 Banking Applications In The USA

Users can perform different mobile payments through smart, responsive, and secure fintech platforms. A digital wallet app offers multiple services for money transfer, authorized login, and expense management. An entrepreneur can choose one or more business models based on the suitability and requirements. Here is a table listing the 10 best banking apps available in the USA for users:

| Top 10 Banking Apps | Supported Devices | Downloads | Ratings |

| Cash App | Android & iOS | 100M+ | 4.3 |

| Bank of America | Android & iOS | 50M+ | 4.8 |

| Chase Mobile | Android & iOS | 50M+ | 4.7 |

| Citi Mobile | Android & iOS | 10M+ | 4.8 |

| Capital One Mobile | Android & iOS | 10M+ | 4.6 |

| Discover Mobile | Android & iOS | 10M+ | 4.4 |

| Chime | Android & iOS | 10M+ | 4.2 |

| PNC Mobile | Android & iOS | 5M+ | 4.8 |

| SoFi Bank | Android & iOS | 5M+ | 4.0 |

| Ally Bank | Android & iOS | 1M+ | 4.0 |

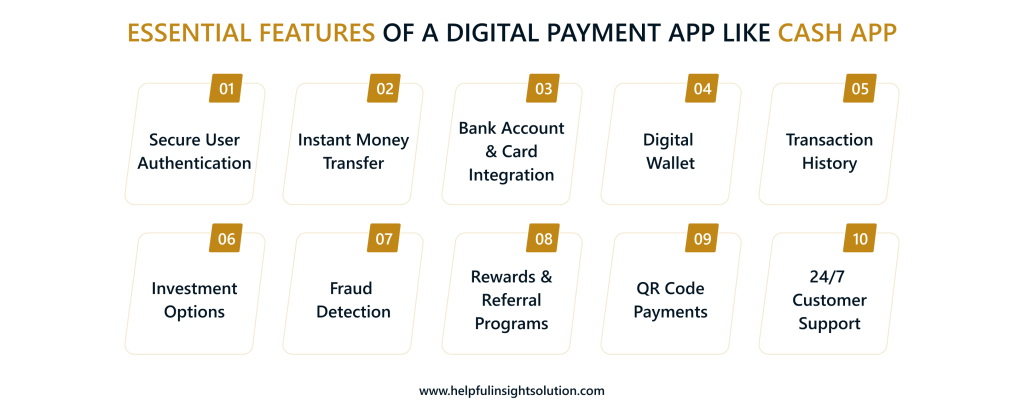

Essential Features Of A Digital Payment App Like Cash App

Various apps similar to Cash App provide exclusively engaging and user-friendly features. They help businesses to attract customers in large numbers and make money through service distribution. A digital wallet app offers the following features for user satisfaction:

1. Secure User Authentication

A mobile wallet application allows users to set multiple authentication methods, like biometrics. This helps them to make secure money transactions and store digital assets without any issues.

2. Instant Money Transfer

The NFC payment feature enables customers to make instant payments for purchases, bills, and recharges. There is only one highly encrypted security layer that reduces time and increases data efficiency.

3. Bank Account & Card Integration

Users can link their bank accounts and integrate debit or credit cards to save time during payments. A mobile wallet app like Google Pay provides similar features with high data and money security.

4. Digital Wallet

This feature in a digital wallet app helps customers keep money for future use and emergencies. They can add or withdraw money from the wallet based on their requirements and personal preferences.

5. Transaction History

Different mobile banking applications allow people to view their transaction history and download receipts. Top apps like Dave offer this feature to reduce chaos and increase platform reliability.

6. Investment Options

Along with mobile payments, users can invest their money in different assets and market shares. They can go through various tutorials and expert guidance before choosing investment options.

7. Fraud Detection

There is an automated AI-powered feature available to detect fraud and scams in fintech applications. You can hire skilled financial app developers who can implement similar services in your platform.

8. Rewards & Referral Programs

A Citi mobile wallet app offers different loyalty programs, like discounted deals, to attract more customers. Additionally, it partners with multiple brands to provide offers on various products.

9. QR Code Payments

Users can perform NFC mobile payments by scanning different QR codes of merchants or individuals. It is one of the quickest methods for money transfer that reduces time consumption.

10. 24/7 Customer Support

A digital wallet app provides constant customer support through integrated chatbots and chat portals. They instantly resolve multiple user queries like payment failure, balance check, and receipts.

What Are The Ways To Monetize Digital Banking Applications?

A business investor may implement several money-making techniques to generate revenue and make profits. These methods help them to balance the banking app development cost easily. We are going to study some important monetization methods in this section:

1. Transaction Fees

Entrepreneurs can charge fees on multiple transactions made by users, such as recharges, bills, or merchant payments. Various top digital wallet applications like Amazon Pay use this revenue model to generate income and boost their business.

2. Advertising Services

It is a very common method used by business investors to make income and increase overall profit. You can hire a fintech app development company to implement this model and run ad campaigns for different brands or market products.

3. Investment Interests

A lot of PayZapp alternatives offer market investment services, such as shares and IPOs, to users for multiple listings. It is beneficial to invest in custom fintech app development, as both the demand and revenue will rise in the future.

4. Data Monetization

Integrated databases help businesses to store large amounts of users’ information that can be shared for revenue purposes. This includes records of NFC mobile payments, user preferences, personal information, and investment accounts.

5. Commission Model

You can integrate complementary features like delivery, booking, and consultation with finance app development services. So, you can apply a commission model to each purchase and make a profit through feature distribution.

Why Choose Helpful Insight For Affordable Banking App Development?

You are now ready to start with fintech application development for business success, user engagement, and revenue growth. To make a proper plan that involves the listing of budget requirements and necessary resources, it is beneficial to hire a full-stack development company. Helpful Insight is the best choice for you, offering the following benefits:

- Access to cost-effective development services, starting from prototyping to maintenance.

- Certified methods to easily reduce and balance the banking app development cost.

- Quick assistance on the latest tools and technologies for making fintech apps.

- And a team of skilled fintech app developers with good industrial experience.

As an entrepreneur, you must get these advantages to build a successful venture in 2026. The mobile banking app development services that we provide are advanced and applicable to all business enterprises. So, you must not waste time searching for more, as the prices are increasing rapidly. It’s time for you to start early and play long in the industry.

FAQs

The average time to develop a digital payment application with basic features typically ranges from 2 to 5 months. The overall duration may increase from 6 months to more than a year, based on various market factors such as complexity and features. Additionally, the development process also influences the deadline due to modifications.

Yes, maintenance and support services affect the cost of building instant payment applications. It typically ranges from 15% to 20% of the overall mobile banking app development cost. For example, if the price of a project is $20,000, then the maintenance cost is between $3,000 and $4,000. These rates may vary based on different parameters, like bug fixing and updates.

Chime-like mobile banking applications provide multiple features and benefits to users. This platform works in the following manner:

- Users log in with personal details.

- Link bank accounts and transaction cards.

- Get e-wallet services for payments.

- Avail rewards, offers, and deals on purchases.

- Contact customer support for queries.

As a business investor, you must know how digital banking apps are being developed. The development stages for a fintech app are as follows:

- Perform market research on financial issues.

- Contact app experts and make plans.

- Start with UI/UX and wireframing.

- Deploy Cloud, API, and database solutions.

- Test and secure the app for better execution.

- Launch the app and provide regular maintenance.

For hiring experienced and skilled mobile app developers, the cost varies in different regions. In Western countries like the USA or Canada, the rate of hiring is more than $60 per hour. But in India or the UAE, the price is between $10 and $25 per hour. Additionally, the cost also depends on the experience level of the developers.

Yes, businesses can generate profitable revenue in 2026 by developing smart and secure banking applications like Revolut. These apps provide multiple features like instant money transfer, mobile wallet, QR payments, and customer support to attract audiences in large numbers. This leads to constant income generation and industrial growth.