“Secure the future of patients by developing insurance software in healthcare.”

People nowadays are increasingly focused on their health due to various growing diseases and medical problems. This allowed hospital owners, insurance companies, government authorities, and HealthTech startups to invest in health insurance software development.

By providing various health claims and multiplied premiums, they can target millions of patients worldwide. The emergence of digital health insurance platforms in the healthcare industry has created multiple opportunities for entrepreneurs.

According to a reputed eco-health journal, the overall healthcare expenditure in the USA was $2.3 trillion last year. This is expected to grow more in the upcoming years, increasing investments in custom medical app development. If you also want to start early and capture the market, then this blog is for you, where we will understand multiple aspects in detail.

This write-up includes the current industrial scenario for businesses, features of healthcare insurance software solutions, the development process, cost, and monetization. So, Let’s begin our journey and explore further in this content.

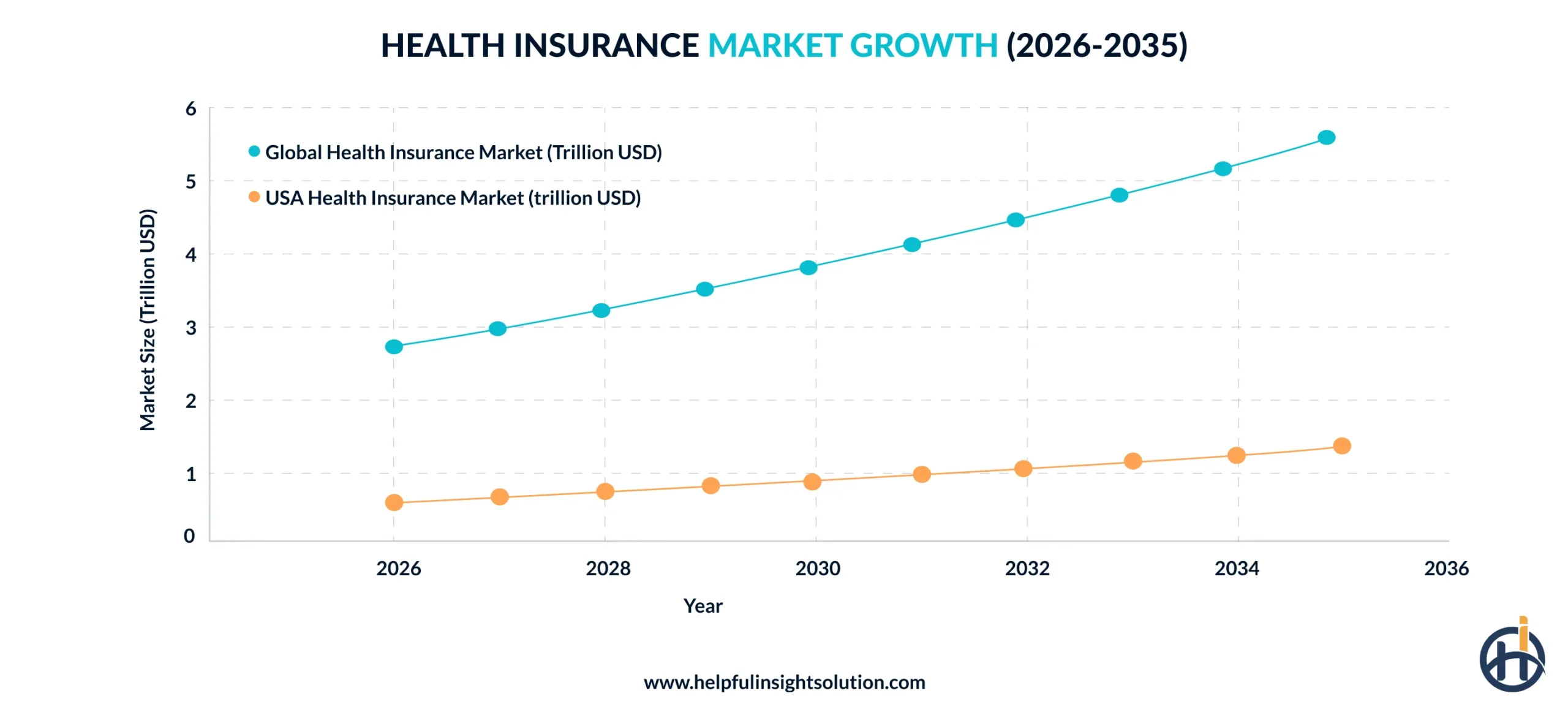

Global Health Insurance Market

Before developing market-defining health insurance software, it is necessary to look at the current industry scenario. This helps businesses get more opportunities and motivation to start early. Let’s understand the following market stats in terms of revenue and growth rate:

- Currently, the global health insurance market size is $2.9 trillion in 2026, which will reach $5.5 trillion by 2035.

- The growth rate is 7.3% CAGR between 2026 and 2035, where North America has the maximum share of 39% in the market.

- Europe and the Asia Pacific region, with shares of 26% and 24%, respectively, are in the 2nd and 3rd positions in this industry.

- The USA health insurance market revenue is $660.1 billion in 2026, which will rise to $1,345.6 billion by 2035, growing at the same rate.

- Among all the insurance segments, lifetime coverage plans have the biggest share of 55% in the overall healthcare market.

Modern InsurTech startups must know the importance of merging insurance and healthcare on a single platform. It is beneficial to create insurance enrollment software for the medical industry, covering a large number of patients worldwide.

What is Healthcare Insurance Software?

A medical platform that provides multiple claim options for operations, treatments, and diagnostics is known as healthcare insurance software. Additionally, it also offers various tools such as a policy premium calculator, search filters, and personalized dashboards for easy access.

This platform is connected with multiple health insurance companies, where patients can compare different policies to select a suitable one. The health plan management software includes various term plans, covering millions of health claims. It uses advanced technologies like AI that help patients get automated insurance claims whenever the tenure is completed.

- Claims Processing—Automates claim submissions, validations, and settlements to reduce errors.

- Policy Management—Helps insurers manage policy lifecycles, assess risks, and price premiums.

- Fraud Detection—Uses AI analytics to identify fraudulent claims, ensuring data security.

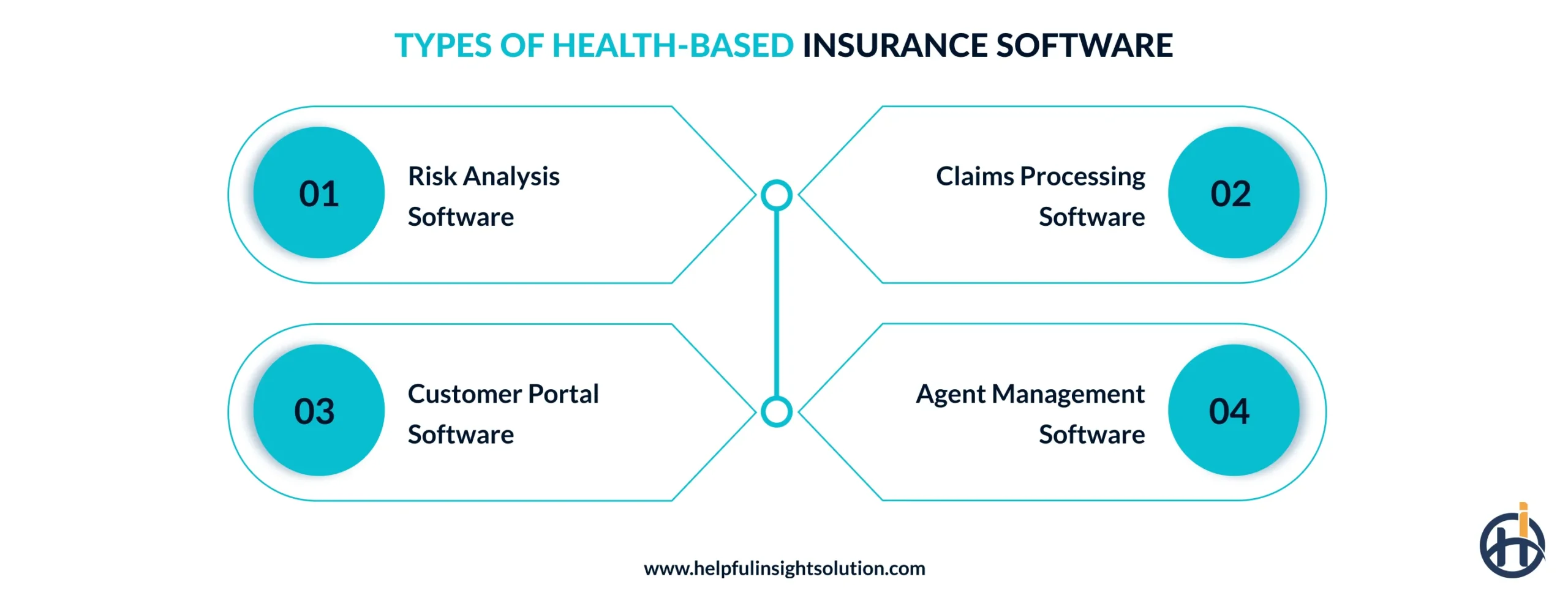

Types of Health-Based Insurance Software

Several health insurance software solutions are available in the market that provide instant claim settlement. Let’s study a few of them in this section so you can choose one based on your needs:

1. Risk Analysis Software

Risk Analysis Software helps insurers evaluate health risks by analyzing patient data and medical history. A modern health insurance management system enables accurate premium pricing and decision-making, reducing financial exposure.

2. Claims Processing Software

Claims Processing Software automates the submission, validation, and settlement of health insurance claims. These insurance software solutions for healthcare minimize manual errors and ensure compliance with regulatory standards.

3. Customer Portal Software

It allows policyholders to manage various policies, track claims, and access health benefits. This insurance claims management software enhances customer experience by offering transparency, convenience, and updates.

4. Agent Management Software

An agent Management platform streamlines performance tracking and commission management for health insurance providers. It improves sales efficiency and ensures agents have centralized access to policies, leads, and customer data.

Why Should Businesses Invest in Health Insurance Software Development?

As there are a lot of benefits of health insurance software, an entrepreneur invests in the medical domain. Here are some common advantages that you must know before starting with the development process:

1. Operational Cost Reduction

Health insurance software automates policy management and claims handling, reducing administrative overhead. By investing in custom app development, you can reduce errors, optimize resource usage, and achieve long-term cost savings.

2. Faster Health Claims

One of the key benefits of insurance software for healthcare providers is that it enables quicker verification and settlement of health claims. Automation and AI-driven workflows reduce waiting time, improving customer satisfaction and efficiency.

3. Regulatory Compliance & Security

Businesses invest in full-stack development to build health insurance software that complies with industry regulations. You should use encrypted and privacy tools to ensure robust security protocols, minimizing legal risks and data breaches.

4. Scalable Advantage

Modern health insurance platforms are scalable, allowing businesses to handle growing user needs and increasing claims. Among the top advantages of developing software for health insurance is that it supports market expansion, ensuring performance and quality.

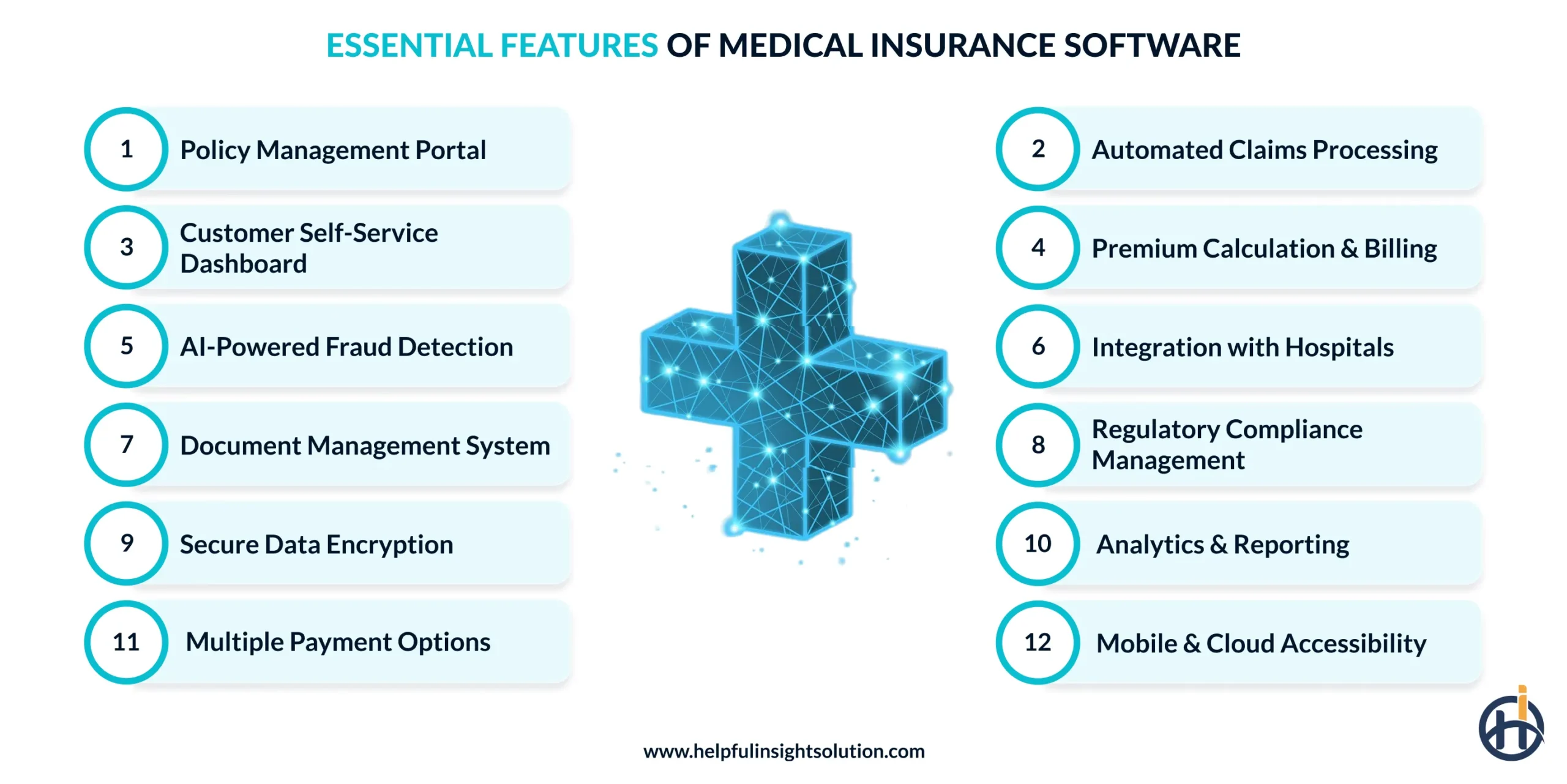

Essential Features of Medical Insurance Software

In this section, we will discuss crucial features of health insurance software, offering transparency and personalization. Additionally, they provide premium and AI-powered features for quick claim settlement:

1. Policy Management Portal

The health insurance management systems allow insurers to create, modify, renew, and track insurance policies. It ensures accurate policy administration while improving transparency for both insurers and customers.

2. Automated Claims Processing

The medical claims processing software streamlines claim submission, verification, and settlement using predefined rules and workflows. It reduces manual effort, speeds up payouts, and minimizes errors and fraudulent claims.

3. Customer Self-Service Dashboard

A user-friendly dashboard allows customers to view policy details, track claims, download documents, and raise support requests. The software for health insurance enhances customer experience by offering access and reducing dependency.

4. Premium Calculation & Billing

Various custom insurance software solutions for healthcare calculate premiums based on coverage, risk factors, and policy terms, managing invoices and renewals. It ensures accurate pricing, timely billing, and improved revenue management.

5. AI-Powered Fraud Detection

The use of AI in healthcare is to identify suspicious patterns and anomalies in medical claims. The health plan management software helps insurers detect fraud early, reduce financial losses, and improve trust in the system.

6. Integration with Hospitals

This feature enables seamless data exchange with hospitals and doctors for real-time verification and cashless claims. The custom health insurance software speeds up approvals, improves coordination, and enhances patient care experiences.

7. Document Management System

The insurance management software for healthcare securely stores, organizes, and retrieves policy documents, claims records, and compliance files. It reduces paperwork, ensures quick access, and maintains document integrity.

8. Regulatory Compliance Management

Several digital health insurance platforms ensure adherence to healthcare and insurance regulations through automated compliance checks and reporting. This reduces legal risks and keeps insurers audit-ready at all times.

9. Secure Data Encryption

The robust software for health insurance protects sensitive customer and medical data by using advanced encryption standards. Additionally, it ensures data privacy, prevents breaches, and complies with data protection regulations.

10. Analytics & Reporting

This feature provides real-time insights into policy performance, claims trends, and customer behavior. A modern health insurance management system supports decision-making and helps insurers optimize operations and profitability.

11. Multiple Payment Options

The healthcare payer software supports various payment methods such as credit/debit cards, net banking, and UPI. This transactional flexibility improves payment convenience and increases policy renewal rates.

12. Mobile & Cloud Accessibility

A health insurance software system offers access to insurance services through cloud-based platforms. Additionally, it enhances scalability, system performance, and user engagement across devices.

How to Develop Software for Health Insurance?

It’s time to develop software for health insurance by observing a certified development process in this section. From planning to deployment, we will discuss every step with detailed information:

1. Market Research & Analysis

This step focuses on understanding the health insurance needs, including regulations and user demands. It involves identifying target users such as insurers, agents, doctors, and policyholders. Market research helps in defining core features like claims processing and policy management.

Businesses can reduce custom healthcare software development risks and ensure better productivity. This phase helps you to make scalable and compliant medical software for users.

2. Start Hiring Teams

Businesses should hire the right team for developing health insurance software. This includes product managers, UI/UX designers, backend developers, QA engineers, and compliance experts. They must have healthcare domain knowledge to handle regulations like HIPAA and GDPR.

A skilled custom healthcare app development team ensures smooth collaboration across different stages. By hiring full-stack experts, you can prevent technical delays and quality issues.

3. Create MVPs

An MVP helps in delivering core functionalities with minimal development effort. It includes essential features such as policy creation, basic claims handling, and user onboarding. The MVP development models allow insurers to gather real user feedback at early stages.

This feedback helps in choosing the right features and prioritizing services. It reduces medical insurance software development costs, expanding the overall market reach.

4. Design User Interface

UI design focuses on creating a simple, intuitive, and accessible platform for users. Health insurance software must support multiple user roles with clear navigation and responsiveness. A well-designed interface improves task efficiency and reduces user errors.

You can hire a health insurance software development company to ensure accessibility standards with interactive designs. A strong user interface builds trust and boosts user adoption across the globe.

5. Integrate Backend Systems

Backend integration connects databases, payment gateways, third-party APIs, and hospital systems. Additionally, it ensures seamless data flow between claims, policies, and customer records. A robust backend architecture supports scalability and performance through integration.

The use of AI in health insurance application development also enables real-time analytics and automation. This step is important for operational efficiency and improved performance.

6. Testing & Security

You must hire dedicated developers for software and ensure good performance under real-world conditions. Functional, performance, and usability testing help in eliminating bugs and errors. Additionally, security testing protects sensitive health and financial data from breaches.

It is mandatory to maintain compliance with healthcare data protection regulations. Thorough testing of healthcare coverage management software minimizes risks before launch.

7. Launch & Post-Development Support

The launch phase involves deploying the software on various platforms and onboarding users. Additionally, continuous monitoring ensures system stability and performance for a long time. Post-development support includes updates, bug fixes, and feature enhancements.

This step is last in the health insurance software development process, ensuring user feedback for major improvements. Ongoing support ensures scalability and regulatory compliance over time.

What is the Cost of Building a Healthcare Insurance Platform?

Now, you will know about the health insurance software development cost that is dependent on various market factors, like complexity and location. On average, there is a specific range if you choose low-priority development tools and features.

The overall cost to build insurance enrollment software may increase further, depending on these factors and their parameters. A cost calculator may help you to estimate accurate pricing based on various parameters. Let’s discuss some important factors in this section:

Software Complexity: Addition of more features increases software complexity and the overall development cost. You should make a checklist before selecting platform features.

Location Choice: Western countries like the USA offer premium services with expensive development models. But in India and the UAE, the architecture is affordable, providing quality.

Experience of Developers: It is crucial to judge the experience of developers based on your budget requirements. You can hire senior developers who are expensive but provide complete technical support.

Tech Stack: Various development tools, like frontend and backend, are affordable and used for making basic software. Advanced technologies such as AI require extra investment and resources.

Security Charges: Security methods like black box testing are expensive, as they involve complete software analysis. Different tools like Wireshark are affordable but not capable of complex tasks.

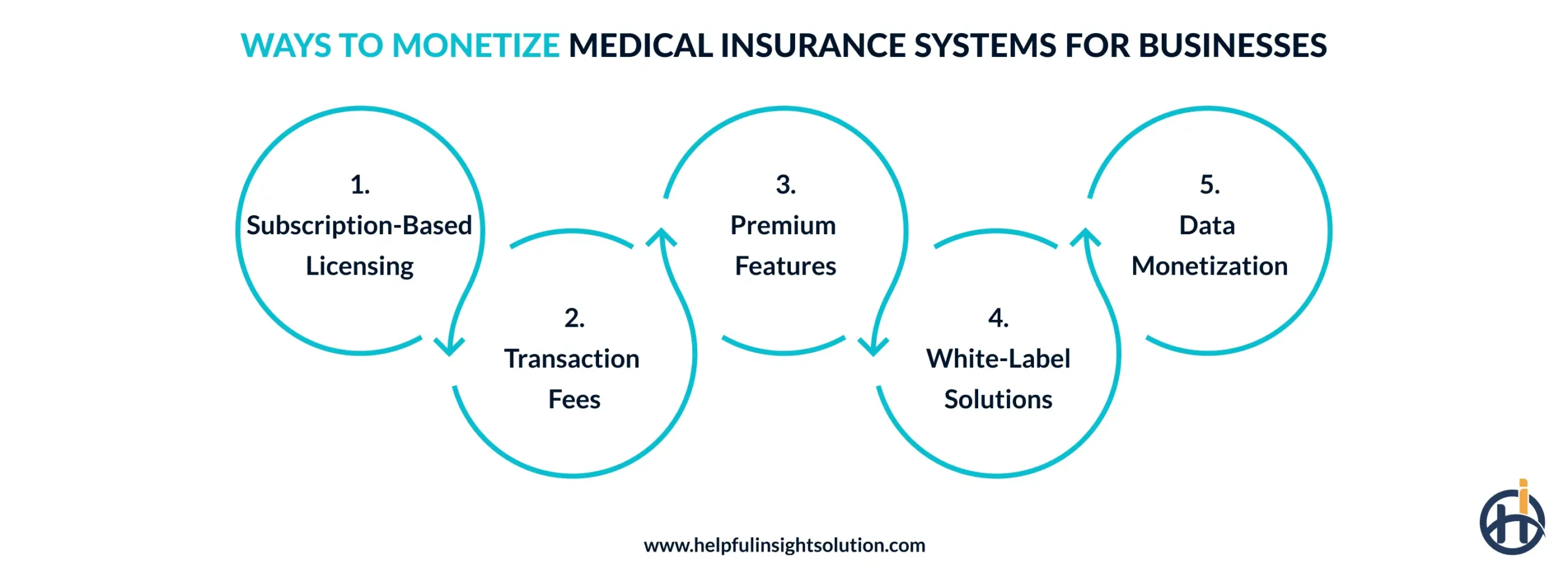

Ways to Monetize Medical Insurance Systems for Businesses

After developing health insurance software, you should implement various revenue models to generate income. We are discussing some of the most important monetization strategies in this section:

1. Subscription-Based Licensing

Businesses can charge a health insurance agency recurring monthly or annual fees to access the medical insurance system. Pricing tiers are often based on user count, features, or data volume, ensuring predictable and scalable revenue.

2. Transaction Fees

Revenue is generated by charging a small fee for every transaction processed, such as policy issuance, claims filing, or premium payments. This model works well for high-volume medical claims software with frequent user activity.

3. Premium Features

Advanced tools like AI-driven risk analysis, claims approval, or detailed analytics in health plan administration software can be offered as paid add-ons. You can hire healthcare app developers to add these premium features, increasing average revenue per customer.

4. White-Label Solutions

Various innovative health insurance solutions can be licensed to insurers or third parties under their own branding for a higher fee. White-label offerings allow businesses to expand reach quickly without additional marketing or operational costs.

5. Data Monetization

Aggregated insurance data can be sold to research firms, healthcare providers, or analytics companies. This approach helps generate revenue and reduce the medical insurance software development cost, maintaining compliance with data privacy.

Why Choose Helpful Insight for Healthcare Insurance Software Development?

Before winding up this blog, we will throw some light on the challenges in health insurance software development. As a business investor, you may encounter some major risks like a lack of ethical support, technical glitches, and compatibility issues.

To create automated and personalized medical claims software, you need a reliable AI development services provider. We have an experienced team that helps in resolving the above challenges through smart solutions.

Additionally, our experts follow innovative trends in software for health insurance that streamline claim settlement, enhancing the overall efficiency. So, it is the right time for medical insurance agencies and clinic owners to invest in custom software development for healthcare. With this, you can increase patient experience and brand visibility in different regions across the globe.

FAQs

A healthcare insurance platform is different from other types of medical software because of its use among patients. Let’s see some important steps to understand the working mechanism:

- Individuals pay regular premiums to an insurer for health coverage.

- The insurer pools this money to spread medical risk across policyholders.

- When medical care is needed, the insured visits approved healthcare providers.

- The insurer pays a portion of the medical costs, while the patient pays deductibles.

- Claims are processed based on policy terms, coverage limits, and exclusions.

Artificial intelligence is one of the most powerful technologies used in the healthcare insurance sector. It has the following roles that influence both patients and doctors on a large scale:

- Automates claims processing and fraud detection with faster decisions.

- Improves risk assessment and premium pricing using predictive analytics.

- Enhances customer experience through AI chatbots and personalized policies.

Businesses can build software for healthcare insurance between 2 months and 5 months, with limited features and functionalities. If they want to add more features with advanced capabilities, then the overall development time may increase to 8 months or more. So, an entrepreneur needs to prioritize requirements based on user needs and market analysis.

A business investor may face some challenges in creating a platform for healthcare plans. Some of the major development risks are described in the following manner:

- Ensuring data security, privacy, and compliance with healthcare regulations.

- Integrating with legacy systems and multiple third-party healthcare providers.

- Managing scalability, accuracy, and user trust in complex insurance workflows.

Software maintenance is an important task that includes bug fixing, feature enhancements, and regular security checks. It is calculated as 15% to 20% of the original development cost that can be varied due to the above factors. If a project cost is $20,000, then the overall cost of maintenance is between $3,000 and $4,000 or more, depending on the requirements.