Do you remember the old-school picture of an investment portfolio developer? Too much paperwork, huge flash screens popping up, and what’s the best thing about it? The guidance and authenticity. But sadly, it has become a memory now. The investing methods today have transformed the entire investing industry.

It’s because the digital space is making its way. In this new era, AI in portfolio management has taken a role. Let’s put it in a clear picture. You are sleeping, and it’s 4 AM on Wednesday, and suddenly your investment portfolio is being analyzed, monitored, and optimized by diverse algorithms providing various data points per second. It’s not rocket science; it’s the AI in portfolio management.

Let us tell you, the finance industry is growing very rapidly because AI is becoming the highlight of it. The global AI in asset management market size was estimated at $3.4 billion in 2024 and is estimated to grow at a CAGR of 25.1% between 2025 and 2034. This data is the reflection of how AI is flowing all over the place, and very naturally, by the way.

This blog will provide you with the 10 benefits and use cases and the differences between traditional portfolio management and AI-based portfolio management. You will see how AI for portfolio management is changing the finance industry. Whether it is analyzing risk management or building a good portfolio for the same, AI is making its space.

Meaning of AI Portfolio Management

AI based Portfolio management is a strategic process in which you select and analyze the portfolios to meet financial goals easily. It involves an equal balance of risk and returns, with consideration of factors such as asset allocation and diversification. Moreover, it relies on human experience and expertise.

When there is a use of machine learning algorithms, it will help in analyzing financial data, which includes market trends and historical performance, to suggest asset locations that sync with investors’ objectives and risk management.

Tip: You can even reach out to a mobile app development company in Dubai if you want to develop your country-specific app.

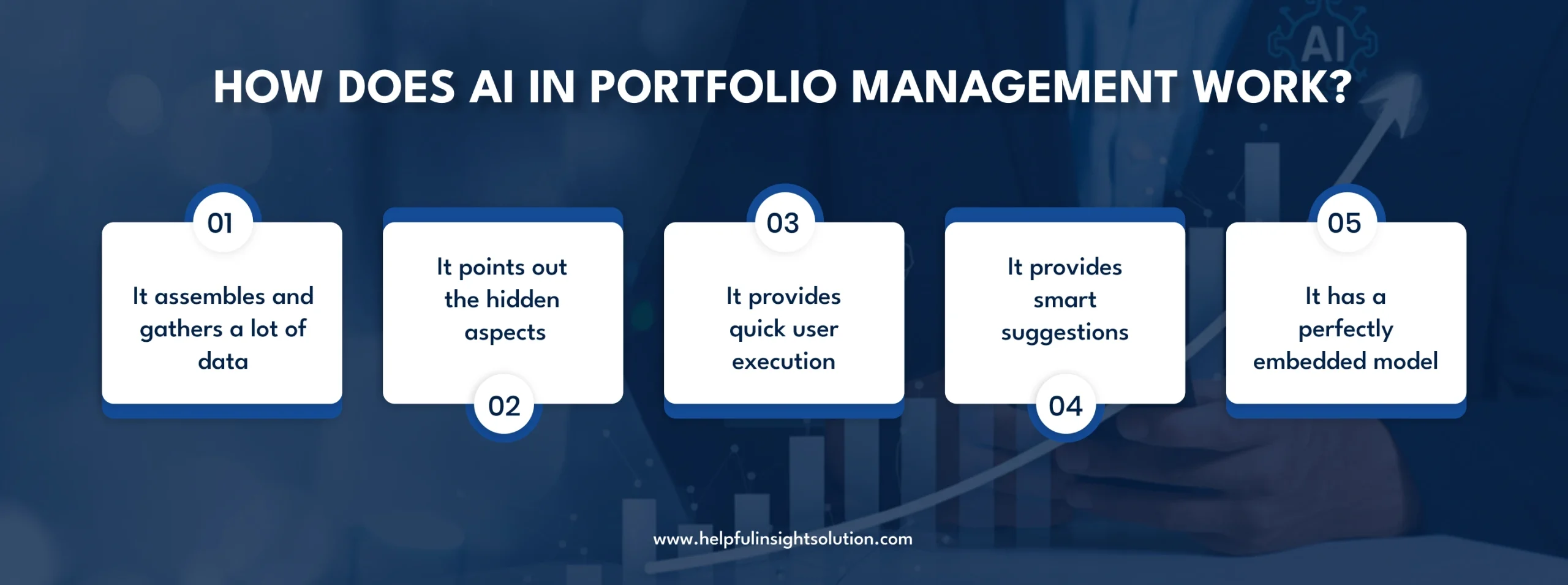

How Does AI in Portfolio Management Work?

Given below is the step-by-step process of how AI in portfolio management works.

1. It Assembles and Gathers a Lot of Data

First of all, AI gathers data from different sources, so the range of data is wider and more varied. The data is just not about stock prices; it covers everything from financial reports to new headlines, client demographics, transaction history, and real-time data on market trends and research reports, asset valuation, and much more.

It gathers all the data so that it is ready to be used in the process. You can even hire app developers in Australia for the same.

2. It Points Out the Hidden Aspects

Now, the AI algorithms are up for work. For example, in AI in portfolio management, the AI algorithms can find certain words in an article that are related to stock movement or asset management. It is a smarter way because humans can sometimes miss such points that could lead to problems in the future.

3. It Provides Quick User Execution

Usually, AI algorithms are smart. The data retrieval and generation process is initiated when the user submits the query to the portfolio management app. This query can be concerning the target company, like their financial aspects and legal compliance status or operational risks.

4. It Provides Smart Suggestions

Based on the different patterns in the portfolio, AI gives recommendations. For example, in AI in portfolio management, AI algorithms suggest that a stock is undervalued or that there is high risk in this particular share.

These are not just random suggestions; these are backed-up conclusions that are based on market data and trends that are happening currently in the market.

5. It Has a Perfectly Embedded Model

The data that is prepared is then processed by an embedding model. It converts textual data into numeric representations called vectors that AI can understand.

There are various embedded models, such as Google and OpenAI, that can make a difference and create something appealing. This model can be developed by hiring mobile app developers as well.

Benefits and Use Cases of AI in Portfolio Management

The future of AI is changing the world, and it is dynamically making its position. Big firms are taking maximum advantage right now. Let’s discover and see what the benefits of AI in portfolio management are in detail, and its use cases as well.

1. It Improves Risk Management and Assessment

Traditional risk models are frequently slow and are based on past data. Therefore, AI in portfolio management changes everything. It assesses in real-time across countless assets. It sees hidden relationships and market fluctuations that eventually humans can forget to see.

It is beneficial for the portfolio managers because it gives a clear scenario about the potential dangers they might come across in the future.

2. Reduces Emotional Biases from Investment Decisions

Emotional decisions such as overconfidence, greed, and fear are the biggest problems in the investing industry. AI in investment management plays a major role in this because when it comes to making investment decisions, it does not involve any of these.

It focuses on logic and data, even if the market is volatile. This ensures that there are long-term strategies involved without panic selling and buying.

3. Time-Saving Factor for Potential Managers and Investors

AI ensures quick decision-making by providing managers and investors with speedy solutions. Usually, the time-consuming process can now be done easily. For example, an AI-driven system can easily tell if the stock value has dropped or is in a position to sell or buy, or if it is open for execution to trade without involving humans.

It is a great factor because traditionally, if we talk about humans, it takes long hours to execute such tasks, but AI has made its space very easily.

4. Customized Investment Strategies

Forget about the traditional AI tools; it’s the power of AI-powered management solutions in the present era that is making its own space. AI can create your profile and then update investment capabilities, income, and risk management. It is just not bound to create a portfolio with specified things; it is about what is required.

When it comes to using AI technology, it is convenient to do so because the algorithms work faster and can make the portfolio even better. Even AI for investment management is quite necessary because strategies help implement the investment decisions to be implemented effectively.

Explore More: AI in Fitness Industry: Use Cases and Challenges

5. Reduces Human Resource Expenses

Human expertise is valuable, but since machine learning in investment management had its emergence, it has created a huge impact. When AI came, it reduced the number of in-house teams of analysts and support staff. Though the job of analysts is less because AI has taken full control of the work. The small group of teams can still manage the teams and will not compromise the quality for anything. It is a great method for big firms because the resource costs are minimized, and it will increase their revenue even more.

Extra Information: UI/UX design is vital for proper AI portfolio management, as it makes hard AI-driven investment strategies easy and actionable for users. This entire thing can be achieved by a UI/UX Design Solution Company, also.

Use cases of AI in Portfolio Management

The examples that are mentioned below are used by the big firms, and, on that basis, a single platform owns everything with ease and perfection. These use cases showcase the value and detailed insights of how AI in portfolio management is playing its role. When you read these, use cases, you will get to know that AI is not just a technology; it is a necessary element that handles the whole database of big firms.

1. Factor Investing Analysis

AI analyzes different types of historical data, market trends, or even correlations to check and analyze the quality, momentum, volatility, and size. AI in investment management has different machine learning algorithms, such as SVMs, which can be used to segment the diversification of the stocks based on these factors to allow for targeted portfolio construction.

A recent study by BlackRock found that AI-powered investing models and AI for portfolio management are increasing and cutting the usage of traditional models. Aladdin uses a powerful predictive analytics tool to help clients know their portfolio better. It can suggest anything related to an increase in interest rate to a geographical crisis.

2. Alternative Data Analytics

AI can process anything; it could be like social media sentiment, credit card swipes, or satellite imaging to know the patterns and correlations that are not possible with traditional analytics. It has ensemble learning techniques that combine predictions from various AI models, which can be used to get valuable data from the big datasets of required data.

Companies like Walmart are mainly investing in data management and using data to resolve such problems across their business operations. They analyze data from different sources to understand customer behavior, streamline supply chains, and enhance marketing strategies.

3. Scenario Analysis and Stress Testing

AI enforces various market scenarios and analyzes stress-free portfolios across different economic conditions, like recession or an increase in interest rates. It helps businesses identify their vulnerabilities and dependencies that could lead to losses.

AOQ Capital Management uses AI-powered scenario analysis to check the conditions and the necessary impact of geopolitical events in its portfolio. This helps in identifying risks and modifying their strategies accordingly.

4. Various Important Strategies

AI uses various hedging strategies to work according to market conditions to overcome losses. There is a high usage of reinforcement models that are trained on historical data to learn optimal strategies in various market environments. It uses inventory management software to manage the inventories and uses a strategic mindset to use it carefully.

JPMorgan Chase uses AI to analyze market trends to identify trading options and check trading activities in real time to ensure regulatory compliance. JPMorgan even uses a business tool called LOXM, optimized by machine learning, for proper equity trade execution.

5. Fundamental Analysis

AI can easily structure and analyze text-based research from different documents such as company filings, news articles, and analyst reports. It explores hidden correlations and checks stocks with a higher probability of outperformance. It uses natural language processing (NLP) techniques to get key insights from textual data.

Magnifi provides information and help with fundamental analysis for finding the stock value. They use different financial approaches that assist in making financial decisions.

Explore More: How AI Is Transforming The Fitness Industry?

Difference Between Traditional Portfolio Management and AI-Based Portfolio Management

|

Factors |

Traditional Portfolio Management |

AI-Based portfolio management |

| Decision-making | Based on human expertise and skills | Based on data-driven analysis and algorithms |

| Information processing | It consists of manual data analysis options | Advanced analytics, machine learning |

| Speed and accuracy | Slow decision-making due to manual process and human errors or biases | It can easily process information and identify market trends to enable faster responses according to market changes |

| Risk control | Based on predefined static models | Faster automated execution |

| Scalability | Slow as it is based on human intervention | Fast, as it has automated algorithms |

| Accessibility | Traditionally limited scope | A wider scope |

How Helpful Insight Can Help in Developing an AI Portfolio Management Platform?

AI portfolio management improves investment strategies and decision-making. It can help in analyzing the vast amount of data with machine learning algorithms to work in an easier manner. It further enhances traditional decision-making practices to make them more effective and adaptive.

If you want to develop an AI portfolio management platform, then Helpful Insight can be a choice for you. If you want to improve your investment approach with advanced AI-driven portfolio management to reduce risks and increase growth, then you can contact us because, as an AI development company, we can help you in every bit of aspect.

FAQs

Yes, you can. An AI-generated investment portfolio uses artificial intelligence to create images and manage an investment portfolio easily. AI algorithms check the huge amounts of financial data, such as market trends, historical performance, and economic data, to make proper informed investment decisions.

Artificial intelligence can help in creating various strategies for making portfolios by checking the correlation of assets and optimizing the allocation of resources to minimize risks. AI algorithms can analyze different investment options and geographic regions to suggest diversified portfolios that increase returns while minimizing market volatility.

Yes, AI can help in risk management with investment portfolios by checking data to identify risk levels in each investment. AI algorithms can even check potential risks, such as market fluctuations, credit defaults, and liquidity issues, to provide proper data regarding the investment portfolios.

Yes, it can work accurately because it has accurate data-driven algorithms that understand users’ behavior and properly analyze what they want in their investment portfolios.