Nowadays, more people are using online banking and digital payments, but this has also led to a rise in financial fraud. You’ve probably heard about criminals using fake videos or tricks to steal money. These scams are happening more often, and both banks and people are getting really worried about it. That’s why the financial industry is turning to a powerful solution like AI agents.

AI fraud detection software has been making waves in many industries, but in finance, it’s really changing things. They are excellent at finding and stopping fraud right away. They also help banks and businesses make better choices when it comes to risks. As a result, more and more fintech businesses are turning to reputable AI development companies to create AI agents.

As per the Grand View Research report, the worldwide AI agents in the financial services market are expected to reach from $490 million in 2024 to over $4.4 billion by 2030. AI in fraud detection is completely changing how banks and financial companies detect fraud and manage risks.

So, if you’re curious about how AI agents in finance are helping in fraud prevention and making online banking safer, keep reading this blog till the end.

Understanding The Increasing Need For AI Agents In Financial Fraud Detection

Do you know that the market for financial fraud detection and prevention is predicted to reach $24.31 billion in 2024 $27.27 billion in 2025, growing by 12.2% every year. Why is this happening? The rise of digital banking has made it easier for fraudsters to attack, and traditional fraud detection systems aren’t strong enough to keep up with modern fraud tactics. That’s why the financial industry urgently needs smart AI agents for financial fraud detection.

Let’s explore some more reasons behind the growing demand for agentic AI for fraud detection and prevention:

- The financial world is changing fast with more digital transactions every day. AI fraud detection solutions can handle millions of transactions instantly, helping to catch fraud before it causes big losses. They’re fast and accurate, making them a must for detecting fraud.

- Fraudsters are always finding new ways to cheat the old fraud detection system, using smarter tricks. AI agents in financial fraud detection can learn from these new tactics and adjust to fight back, helping to stay ahead of the criminals and protect against newer threats.

- Conventional fraud systems often mistakenly flag real transactions as fake, which frustrates customers and overloads workers. These systems are slow and don’t learn, leaving banks vulnerable. AI agents for fraud detection are very much needed to keep up with today’s fast-paced world.

Read Also: Generative AI in eCommerce: 10 Use Cases of How AI is Changing the E-commerce Industry

Benefits Of Using AI-Powered Fraud Detection In Financial Services

If you’re unsure about investing in an AI fraud detection banking system, as a trusted banking app development company, we reassure you that there are numerous benefits to using AI to detect fraud. Trust us, AI-based fraud detection in banking is a powerful tool that will completely transform how you fight and prevent fraud.

1. Real-Time Fraud Detection

Implementing AI fraud detection solutions helps banks and financial services catch fraud as it happens. When fraudsters try to break in, an AI-based fraud detection system instantly spots any suspicious activities, so you can act fast and stop the fraud before it causes major damage. It checks transactions in just milliseconds, keeping your system safe.

2. Reducing Human Errors

Let’s be honest that humans can make mistakes, and in finance, even small errors can cost a lot. AI in fraud detection helps reduce these mistakes by automating processes. Unlike humans, AI doesn’t get tired or make typo mistakes. It carefully checks data, ensuring accuracy in records and transactions, leading to more reliable results and fewer costly errors.

3. Keep Up With New Fraud Tactics

As technology rapidly evolves, fraudsters are also finding new ways to commit fraud in our tech-driven world. To stay ahead, financial service providers must improve their fraud detection methods by integrating AI. AI fraud detection systems continuously learn from new data, allowing banks and financial institutions to detect and stop the latest fraud techniques before they become a serious issue.

4. Saves Cost

Fraud detection artificial intelligence systems greatly save money by reducing fraud losses and cutting down on the need for manual checks. Instead of paying staff to review every transaction, AI agents in banking can do it faster and cheaper. This means fewer mistakes and lower costs for companies, making financial services more efficient overall.

Explore More: Adaptive AI vs Generative AI: Understanding The Major Differences

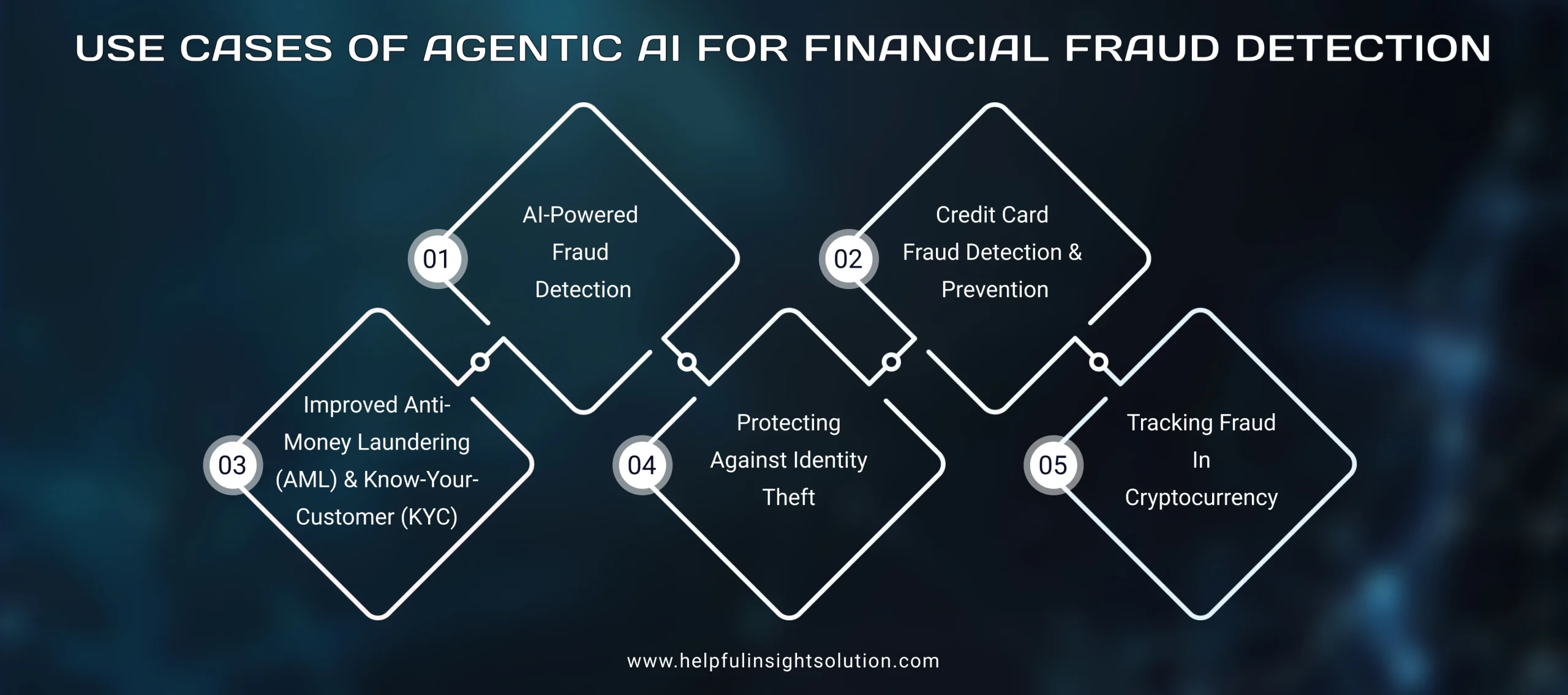

Use Cases Of Agentic AI For Financial Fraud Detection

Did you know that 76% of financial institutions are already using AI to fight fraud? This shows how valuable AI agents are for fraud prevention in the fintech sector. AI agents help by spotting suspicious activities faster and more accurately. Instead of just reacting to fraud, AI in banking fraud detection helps to stay ahead of it and stop it before it happens. AI agents for fraud detection offer some amazing applications that are truly making a difference in fraud prevention.

Want to know about the use cases of AI in fraud detection? So let’s have a look:

1. AI-Powered Fraud Detection

AI agents work nonstop to keep an eye on all transactions, device data, and behavior patterns. It instantly detects anything suspicious that might look like fraud. Unlike old systems that just give alerts, AI fraud detection solutions can stop suspicious transactions, notify the team, and even start the process to verify customers right away. If a hacker tries to make a large withdrawal, AI agents in banking can freeze it instantly, notify the bank, and start customer verification right away.

2. Credit Card Fraud Detection & Prevention

Credit card fraud is one of the top areas where AI agents for fraud detection help a lot. It watches transactions in real-time, looking for unusual patterns, like multiple purchases in different locations within minutes. It also learns how a person typically spends and flags when something seems off, like buying from a spam website or using a new device. If someone else uses your card in two places at once, an AI-enabled fraud detection solution can immediately notify you.

3. Improved Anti-Money Laundering (AML) & Know-Your-Customer (KYC)

Have you ever wondered how banks make sure your identity is safe and that money transfers are legitimate? Well, AI agents for fraud detection in financial services automate the process of verifying who clients are (KYC) and checking transactions for money laundering. It can catch things that humans might miss, like unusual transaction patterns or fake IDs. This helps banks spot fraud and illegal activities faster and more accurately.

4. Protecting Against Identity Theft

It is natural for people to be worried about identity theft in today’s tech-driven world. Thankfully, AI can help banks tackle this issue and build trust among their customers. AI systems can detect fake or stolen identities by looking for patterns in behavior and using technologies like facial recognition. It can also spot changes in identity documents and even catch deepfake attempts. So, if someone tries to use a stolen identity, AI-powered fraud detection can quickly identify the difference in facial features and stop them from accessing accounts.

5. Tracking Fraud In Cryptocurrency

Cryptocurrency can be tricky for traditional systems to track because it’s often hidden. But AI agents are great at monitoring blockchain transactions and finding anything unusual, like quick or frequent money transfers. This helps spot stolen crypto or illegal payments that fraudsters try to hide. With AI fraud detection in finance, banks can catch fraud faster. For example, if a lot of crypto moves to an unknown wallet, AI raises an alert before it’s too late, helping stop fraud before it happens.

Explore More: AI in Portfolio Management: Best Benefits and Use Cases

Steps To Implement AI Agents For Fraud Prevention

If you’re considering integrating AI-powered fraud detection into your bank or financial institution, it’s a brilliant move. We know you may have a lot of questions, like how to start, what the best approach is, and what to do if something goes wrong. As a top-rated AI app development company, we can tell you that successfully implementing an AI fraud detection solution requires the right expertise, knowledge, and strategy.

In this section, we’ll guide you through how to get started with AI-enabled fraud detection in your enterprise.

1. Evaluate Your Existing System

The first thing to do is to assess your current fraud detection system and check how your current system works. Look for things that can be improved, like tasks that can be automated or mistakes your system makes, such as missing fraud or flagging real transactions. By understanding where it’s weak, you’ll know where AI fraud detection in finance systems can help make things better.

2. Create Right Integration Strategy

To make AI work with your current system, you need a good plan. Start by testing AI on small tasks first. Move important data to the cloud so AI agents can easily use it. This will help avoid problems and let everything work smoothly. For example, start using AI to check low-risk transactions first before moving to more important tasks.

3. Hire AI Development Company

It’s best to hire reputable AI developers USA who are experts in creating and implementing agentic AI for fraud detection. They should understand the banking industry well and help make AI models work well with your system. Also, look at their past work and client testimonials to see if they can meet your needs or not.

4. Data Collection and Preparation

The next step is to collect high-quality and reliable data, so gather both fraud and real transaction details. Clean up the data and make sure it’s ready for the AI agent to use. This helps the AI learn better and spot fraud. Look for important patterns in the data that can help the AI in fraud detection systems find suspicious activities.

5. AI Model Training

After preparing the data, hire dedicated developers will start training the AI model. Picking the right training method is very important as the data you’ve collected to teach the AI to spot fraud. Make sure the model works well and check if it’s accurate and fair regularly. If you’re checking for fake transactions, train the AI to find patterns in buying behavior.

6. Deployment and Monitoring

Once your AI agent is trained and tested, you can integrate it into your existing systems. We highly suggest you to continuously monitor the performance of your AI system to check whether it is working properly or not. If any issue persists, immediately fix it, after all it is the matter of finance.

Explore More: What Is Agentic AI? Features, Benefits & Challenges

Develop Robust and Scalable AI Solutions With Helpful Insight

Fraud detection using AI is gaining huge popularity, and for good reason. With access to such a powerful tool, why not use it? AI solutions for fraud prevention have quickly evolved from “nice to have” to “must-have” in the fintech industry. As a result, more and more businesses are eager to integrate AI into their operations. Are you searching for the best AI development service provider in the USA to create scalable and efficient AI agents for fraud detection? Well, the good news is, your search ends here with Helpful Insight.

We are a trusted AI software development agency that holds 14+ years of experience in creating high-quality and powerful AI fraud detection solutions. Our team holds deep expertise in using high-tech AI tools and technologies to develop AI fraud detection systems. The AI agents we create are excellent at identifying fraud, helping enterprises transform their risk management processes.

If you’re interested in developing AI agents for financial fraud detection, reach out to our team today. We’ll get back to you as soon as possible.

FAQ’s

In so many amazing ways AI in fraud prevention is transforming the financial industry. AI agents are helping banks to smartly and quickly detect fraud by looking at huge amounts of data and finding strange actions that might be fraud. It learns from past fraud cases and gets smarter over time. This helps keep money safe and stops financial frauds before they happen.

Well, there are so many factors which influence the cost to build an AI agent, which includes AI solution complexity, data requirements, model training, AI development company’s location and much more. So, it’s a little bit difficult to give an exact figure but for detailed cost estimation, reach out to our team, share your requirements, and we will provide you with a custom quote.

The future is really bright. AI in fraud detection banking is getting smarter every day and will help stop more fraud in future. It will keep improving with time and protect people’s money even better. This means safer financial transactions and faster alerts if any fraudulent activities happen.

Some of the main challenges in implementing AI fraud prevention systems are low-data quality, difficulty in integrating with legacy systems, data privacy and ethical concerns.