Mobile App Development Company

We create high-performance mobile apps that empower businesses to drive measurable business growth.

To succeed in a digital-first world, secure and scalable apps are key. Enhance efficiency, engagement, and revenue with trusted, impactful solutions.

is expected to be the size of the global mobile app market by 2030.

boost in customer retention can be achieved through custom apps.

of companies using mobile apps experienced a boost in productivity.

As a trusted mobile app development partner, we help startups and enterprises create high-quality apps. We guide you to go mobile-first and ensure maximum ROI.

We excel in developing user-friendly Android apps using programming languages like Java and Kotlin, ensuring seamless experience across all Android devices.

Seamless Integration

We will ensure that the app works smoothly with your current systems, streamlining workflows.

High Customization

Your Android application can be tailored to fit your brand and business needs, making it unique.

iOS app developers at Helpful Insight specialize in building fully functional, user-centric iOS applications for the Apple ecosystem, utilizing best practices.

Performance Focused

We ensure that the iOS apps are fast and offer great user experiences across all Apple devices.

Scalable & Secure

We design iOS applications that grow with your business and are highly secure, protecting data.

Our progressive web apps deliver a mobile-like experience while being easy to access on the web, ensuring smooth performance and boosting user engagement.

High Performance & Reliability

Our PWAs offer fast and smooth user experiences even on mobile devices with limited resources.

Offline Accessibility

Progressive web applications load instantly and work well even with slow internet connections.

Using Flutter, our mobile app developers create visually appealing mobile applications for both Android and iOS using a single codebase and at a lower cost.

Cross-Platform Reach

One codebase means your mobile app solution works on both Android and iOS, reaching more users.

Cost-Effective

Flutter app development is an affordable way to build top-notch applications for Android and iOS.

Our team utilizes React Native to build fast-performing apps with smooth navigation that meet specific business needs and provide native-like performance.

Flexible Architecture

React Native applications we develop will easily grow with your business and evolving technology.

Rapid Development

With React Native, mobile app developers can quickly build apps that perform well on all devices.

We develop interactive web apps that give the feel of a native app while working through a browser. Our web apps are much more functional than regular websites.

Real-Time Updates

Our web applications can update content instantly, providing a dynamic and engaging user experience.

Cross-Device Accessibility

Web apps are accessible on any device; all you need is an internet connection, ensuring wide reach.

We specialize in creating mobile app solutions that work perfectly on iOS & Android using the same code, ensuring a consistent experience on every device.

Wide Compatibility

Our apps function effectively across different operating systems, and even Windows for broader reach.

Faster Development

Our developers use the same code to develop cross-platform apps, speeding up the development process.

We craft wearable apps that run flawlessly on different wearable devices like smartwatches. Our apps are built securely, sync in real time, and fit user needs.

IoT Integration

Our mobile app development firm uses advanced protocols to connect with wearable devices effortlessly.

User-Centered Design

UI/UX designers at Helpful Insight creates user-friendly designs that fit wearables' small screens.

Don’t just build an app; build a success story. Partner with Helpful Insight to create mobile apps that engage users, boost efficiency, and fuel business growth.

Investing in custom mobile application development services can bring a 360° transformation to various areas of your business operations, leading to success.

Boost Consumer Engagement

Mobile applications provide you a platform to connect with customers directly. Users can browse your services, and contact you anytime.

Strengthen Brand Image

Having an app makes it easy for people to remember your brand and builds trust. It makes your brand stand out and acts as a constant brand representative, creating positive impressions.

Drive Sales & Revenue

Mobile apps provide convenience to customers to shop with your brand anytime. This encourages repeat business, increases order values & boosts sales, all while reducing marketing costs.

Gain Competitive Edge

We live in a mobile-first world, and businesses that have an application will stay ahead in the race. It improves user experience and makes your business more accessible.

With deep expertise across 30+ industries, our mobile app development team creates custom solutions, driving innovation and meeting your industry needs.

Healthcare

We excel in building apps for the healthcare industry, designed to streamline business operations, providing easy access to healthcare and improving patient care.

Electronic medical/health record apps

Telemedicine app solution

Pharmacy management system

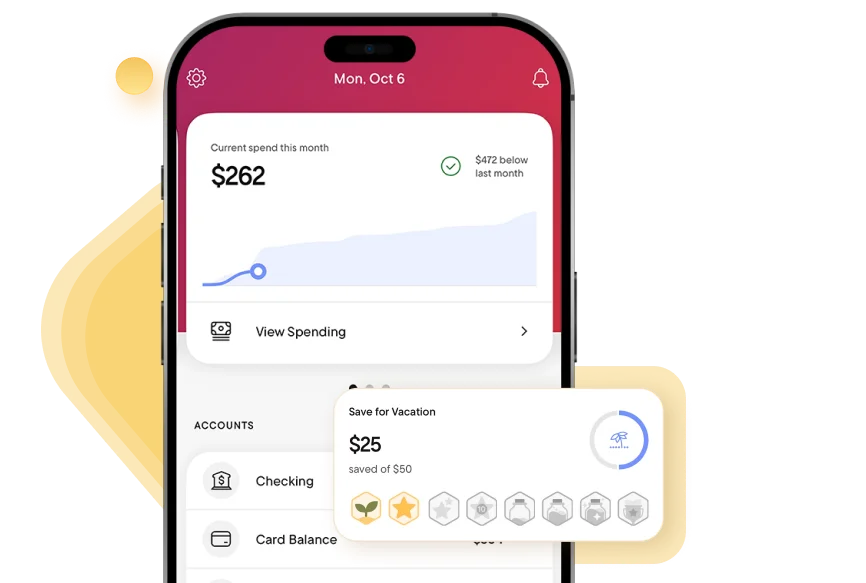

Banking and Finance

Our app developers craft fully secure banking and finance apps that simplify workflows, deliver the best user experience, and help reduce customer service costs.

Money transfer apps

Investment management apps

Lending and credit apps

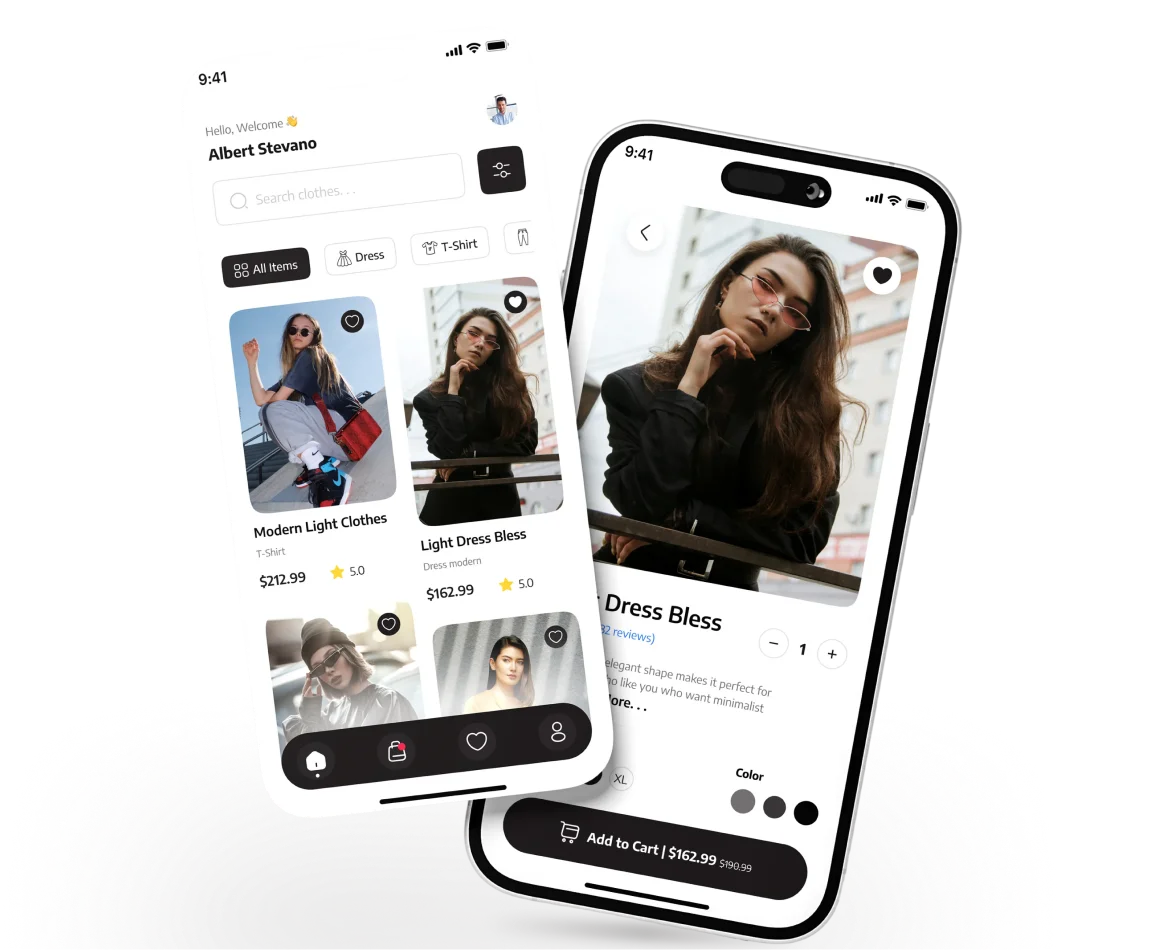

Retail and eCommerce

Boost conversions, amplify sales, and reach a global audience with our high-end retail and eCommerce app solutions that perfectly resonates with your brand identity.

Multi vendor marketplaces

In store and POS apps

B2B and B2C eCommerce apps

Manufacturing

Digitize manufacturing operations with custom mobile app development services. We integrate latest technologies like AI in manufacturing apps to enhance efficiency.

Safety management apps

Production monitoring apps

Vendor management apps

Real Estate

We build smart real estate apps that make buying and selling properties easy. In-app chat, virtual tours, and AI voice search are some key features of our mobile apps.

Property management apps

Real estate marketplace apps

Tenant management solutions

Media and Entertainment

Get scalable and user-friendly entertainment applications developed, delivering a premium quality experience. We can develop clones of top leading entertainment apps.

OTT platform development

Social networking apps

Live video streaming apps

Fitness and Wellness

We develop user-centric fitness applications that assist wellness businesses and gym club owners in expanding their reach and delivering personalized support to users.

Exercise and workout apps

Meditation apps

Fitness tracking apps

Games and Sports

Our app development agency knows what it takes to develop bespoke gaming and sports mobile applications that deliver an engaging user experience and make people hooked.

Fantasy sport apps

Sports betting platforms

Sports league management solutions

Education

E-learning apps that we design personalize student learning experience and help teachers automate admin tasks, dedicating their focus to improving learning outcomes.

E-learning portal system

Corporate training apps

Language learning apps

Restaurant

Our mobile app developers create robust and versatile apps for the restaurant industry that automate day-to-day operations and make managing and delivering orders easy.

Food delivery and ordering apps

Inventory management apps

Restaurant POS solutions

Get responsive and user-friendly mobile apps designed for every device.

We employ most advanced tools, technologies and programming languages to develop innovative mobile apps.

Java

Node.js

PHP

C++

Swift

Python

Flutter

React Native

Ionic

Xamarin

PostgreSQL

MySQL

Oracle

SQLite

Firebase

Firebase Authentication

Auth0

SSL Pinning

Keychain Services

Stripe

PayPal

Square

Apple Pay

Google Pay

AWS

Google Cloud

Microsoft Azure

AI is transforming every industry, and we ensure our clients stay ahead by utilizing its potential. That’s why we integrate AI into our mobile apps. Our accredited AI app developers excel at creating secure, scalable, and intelligent applications that automate workflows, deliver personalized services, support data-driven decisions, and drive real-world results.

Our AI app development company has extensive experience building various AI-driven applications, including voice recognition apps, RPA solutions, and AI-based virtual assistants. By integrating artificial intelligence, we elevate average-performing apps into high-performing ones, helping businesses scale and grow. Whatever your app idea is, we’ll turn it into a cutting-edge AI-powered solution that accelerates your digital transformation journey.

With years of industry experience, we master the art of creating custom mobile apps that delivers real, measurable results.

Clutch recognizes us for our top-tier mobile app development services, with a 5-star rating, a testament to our excellence.

What we promise, we deliver, and our 100+ successfully delivered app development projects clearly prove our expertise.

Our app development agency holds ISO 9001:2015 certification, ensuring our apps meet the highest quality standards.

With a 95% client retention rate, it's clear our certified developers build lasting trust and achieve successful outcomes.

We build mobile applications that users adore worldwide, reflected in their consistently high ratings and positive feedback.

The growth we drive for our clients is the reason behind their positive feedback & appreciation.

Our mobile app development company offers a full spectrum of app development services, including mobile app consulting, UI/UX design, custom app development, app modernization, and support and maintenance. By partnering with Helpful Insight, all your mobile app development needs will be met under one roof, and that too at cost-effective rates.

The mobile app development cost is influenced by a wide range of factors, such as project scope, mobile app development platform chosen, app type, UI/UX design, the location of the mobile app development agency, tech stack chosen, and many more. Therefore, it is difficult to determine the exact cost.

But don't worry; once you share your app requirements with us, we will equip you with a custom quote. You can also try using our free cost calculator to get a quick cost estimate.

The timeline to create mobile app development solutions is affected by a number of variables. It includes project complexity, customization level, app design, third-party integrations, app testing, etc.

To get accurate timeline, get in touch with our mobile app development team and share project details. Once we analyze the requirements, we will equip you with a realistic timeline. At Helpful Insight, we are committed to delivering mobile app development projects on time, ensuring you can quickly roll out the app in the market.

Of course, we can. No matter what type, size, and scale of mobile application you want, we have the expertise to develop it. The app is yours, and we will build it exactly as you want. Freely share your app vision with us, and we will leave no stone unturned to bring it to life.

When you choose Helpful Insight as your mobile app development partner, rest assured that your app idea is completely safe. To provide you with peace of mind, we sign a Non-Disclosure Agreement (NDA).

Explore expert insights to fuel your digital transformation and growth journey.